Facing a denial when applying for insurance can feel frustrating and overwhelming, especially when coverage is essential for protecting your health, property, or livelihood. Whether it’s health insurance, life insurance, auto coverage, or any other type, being told “no” raises immediate questions: Why was I denied? What can I do now? Is there any way to secure coverage despite this setback? While it may initially seem like a dead end, a denial is often just the start of a process, not the conclusion. Understanding what steps to take after a denial can empower you to find the right solution and safeguard your interests.

First, it’s important to recognize that insurance denials occur for a variety of reasons, and not all are permanent or insurmountable. Sometimes, the issue stems from incomplete or inaccurate application information, while other times, it relates to underwriting decisions based on risk factors like health history, credit scores, or claims records. For example, if a health insurer denies coverage due to pre-existing conditions, there may be regulatory protections or alternative plans available. Similarly, auto insurance denials could be tied to a poor driving record or location, but might be remedied by adjusting coverage options or seeking specialty insurers. Knowing the root cause is critical before moving forward.

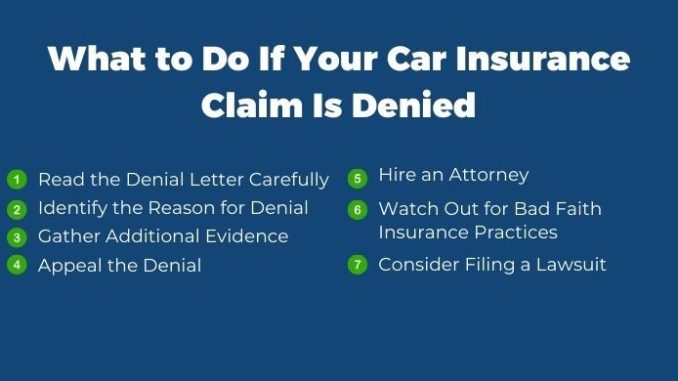

When you receive a denial notice, the first practical step is to carefully review the explanation provided. Insurers are typically required to send a clear reason for denial, whether it’s a medical condition, lack of documentation, or failure to meet eligibility criteria. Understanding this reason allows you to assess whether the decision was justified or if there might have been an error. For instance, if the denial cites missing medical records that you didn’t know were required, obtaining and submitting those documents could reverse the decision. Likewise, if there was a misunderstanding about your employment status or residency, clarifying these details might open the door to coverage.

If you believe the denial was made in error or unfairly, don’t hesitate to appeal. Most insurance companies have an appeals process that allows applicants to request a review of their case. This often involves submitting additional documentation, letters from doctors, or other evidence that supports your eligibility. For example, a life insurance applicant denied due to a past illness might provide a doctor’s letter confirming recovery and good health. Although the appeal process can take time and patience, it is an important avenue to explore before seeking other options. Persistence here can sometimes lead to approval or a modified offer that suits your situation better.

When appeals aren’t successful or the reasons for denial are more structural, it’s wise to explore alternative insurance options. This may mean turning to different insurers that specialize in high-risk applicants or policies with fewer restrictions. In health insurance, for example, government programs or marketplace plans may provide coverage options that private insurers declined. Auto insurance companies catering to drivers with challenging records exist, and though premiums may be higher, some coverage is better than none. In property insurance, specialty insurers can handle homes or belongings that standard providers reject. Knowing that a denial from one company doesn’t close off all possibilities is key to finding a workable path.

Another important consideration is improving your overall profile to reduce the risk factors that led to denial. While not always quick, steps such as improving your credit score, maintaining a clean driving record, or managing health conditions more proactively can positively impact future insurance applications. For example, someone denied auto insurance due to multiple tickets might take a defensive driving course or simply avoid violations over time to become eligible again. Similarly, addressing health issues under medical supervision can open doors for life or health insurance down the road. Viewing insurance denial as feedback rather than failure encourages a longer-term strategy to secure coverage.

In addition to these practical steps, seeking guidance from knowledgeable professionals can make a significant difference. Insurance agents, brokers, or financial advisors often understand the nuances of underwriting and can suggest tailored products or strategies you might not find on your own. They can help interpret denial letters, manage appeals, or identify niche insurers that fit your profile. For individuals navigating complex denials, working with experts ensures you don’t miss critical deadlines or documentation that could influence the outcome. Their expertise transforms what feels like a maze into a more manageable journey.

Finally, it’s essential to remain proactive and avoid gaps in insurance coverage whenever possible. A denial might tempt some to forgo insurance altogether, but this can leave you exposed to significant financial risks. Instead, even limited or short-term coverage can provide a safety net while you address the underlying issues. For instance, a student denied a particular health plan might explore temporary or catastrophic coverage to avoid being uninsured. Likewise, drivers with difficult histories might accept higher premiums initially, working towards better options in the future. Being uninsured often costs far more in the long run through out-of-pocket expenses or legal consequences.

In conclusion, being denied insurance is a challenging experience, but it doesn’t have to be the end of the road. By understanding the reasons behind the denial, carefully reviewing your options, appealing when appropriate, and seeking expert guidance, you can often turn a setback into an opportunity. Insurance providers vary widely, and alternative plans or strategies can bridge the gap. Taking proactive steps to improve your eligibility, coupled with persistence, increases the chances of securing the protection you need. Above all, maintaining coverage—even if imperfect—is crucial to managing risk and protecting your financial wellbeing. A denial may feel like a door closing, but with the right approach, you can find another door waiting to open.

Leave a Reply